Q1 2024: 17.88%, CNOOC, Topicus, BestMart 360 and Plover Bay

Disclaimer: By reading this article, you acknowledge and agree to the terms and conditions.

I’ve been investing seriously for a few years now. While I can’t claim to have balance sheet x-ray vision, I’ve never had industry experience, we have been beating the market for some time so I’d like to claim I am not a completely incompetent investor. I wanted to start documenting my journey a little more publicly for a few reasons: to hold myself accountable so I don’t do anything so stupid I’d feel bad for sharing it publicly, to share more of how I think with our future kids years down the road (they are the most important beneficiaries, I think about them as I write this), and maybe there are folks out there that might want to chat about investing.

Q1 performance in 2024 is 17.88%. I suppose this stacks up favorably to the SP500’s 10.79% or the Nasdaq Composite’s 9.32% but I’m not sure if even having a benchmark makes any sense. I am investing for our future family and that means safety is of paramount concern over returns. This means, at some point, we will vastly underperform the indexes.

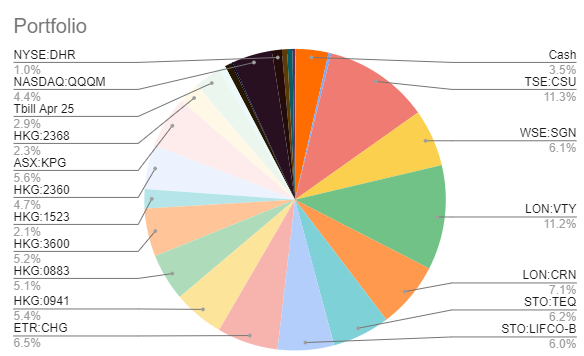

I think our portfolio in terms of three themes:

Serial acquirers - Jockey investing in managers which have a set criteria and an operating playbook where instead of returns being derived primarily from organic growth, it is through acquisition. Generally, the multiples I (and the market) is willing to pay for these high quality businesses is fairly high.

Housing - Many OECD markets have had a long period of underbuilding of housing. It’s not obvious to me that the houses themselves will see appreciation, but it is obvious to me that certain players in the housing supply chain have a large runway for growth/investment at high rates of return. Some additional thoughts here.

Value investing in HKEX - The world has been fed a narrative about Hong Kong/China which seems more fantasy than reality. In addition, nearly every fund manager I have talked to who’s invested in China is shell shocked. As a result, many companies are trading at nonsensical valuations.

There were two notable cuts/trims in the portfolio:

Topicus - A serial acquirer in the Constellation Software portfolio, headquartered in the Netherlands, that is trading somewhere around 55x “owners” free cash flow. Apparently Topicus and Lumine represent about 29% of the TSX Venture Exchange. There are very few companies I am willing to hold at this kind of a valuation. Topicus’ parent, Constellation Software, is a more diversified entity, has a lower percentage allocated to non-controlling interest cash flow payments, and has an arguably better management team, so I have cut our Topicus holding almost entirely. Still, I wouldn’t bet against Topicus in the very long run.

CNOOC - We bought this entity as US shareholders were forced sellers as a result of Trump’s banning of US ownership. CNOOC is one of the world’s highest quality oil exploration/production (E&P) company that was trading somewhere in the low single digit multiples when we bought it. It has done very well. However, oil is still a cyclical commodity and I feel there are better risk/reward positions out there. Still we hold a position in CNOOC and hope to be long term shareholders. In theory, if CNOOC grows production 5-8%, we see a 7-8% dividend, if crude pricing stays where it is, returns from here on could be 12-16%.

A few notable additions:

Best Mart 360 - There are a few stores in the world I am loyal to: Costco, Trader Joe’s, Decathlon, Ikea, and Best Mart 360. Why? They provide extraordinary value for a low price. On average, our bill at Best Mart 360 is similar in magnitude to a grocery store despite the typical Best Mart 360 being a fraction of the size of a grocery store. They don’t typically have perishables and many/most of their items have subscription like dynamics (ie. cereal, nuts, wine) as they are consumed regularly. Contrast this to a name like International Housewares Retail Company where it seems unlikely someone is going to buy a new fan or rice cooker every week. Even during the difficult years of 2021, 2022, 2023, they grew revenue by about 32%, 22%, and 16% respectively. Consumers might not buy houses or purses in hard times, but they are going to snack through thick and thin. As they have quite a few stores 167 (Welcome and Park n’ Shop have something like a combined ~540), it seems their growth in HK can potentially double or triple but maybe not 10x. As a result, they have been diversifying into other retail concepts and geographies. I have no opinions on those initiatives. There are more details like their deal with the SOE, China Merchants as well as change of governance I won’t get into but are very important. However, at an LTM PE of ~8x, founder shareholder alignment, I think the business is a steal given the quality and the history of shareholder rewards via dividends.

Plover Bay - A producer of routers which can bond various channels including mobile, Starlink, etc. What this means is an end user can use a wifi connection but bits are transmitted over multiple physical channels so as to have higher bandwidth, higher reliability, etc. Channel bonding itself isn’t a very new concept and I do not see the technology as producing any particular moat. However, the market itself is in the magical sweet spot of growing but being too small for larger router companies to pay attention. Clay Christensen students would rejoice upon seeing market dynamics like this. Most of the attention in the space seems to be on security or AI (ie. DC connectivity) as the upside in those spaces is much larger and the competition much more fierce. As a result, it doesn’t seem obvious to me that they will see any serious competition resulting in perhaps, above average growth and operating margins. The management team appears to be incredibly shareholder friendly. However, because I do not see this company as having an impenetrable moat, it’s not a huge/full position for now.

Very interesting write-up, Brandon!

ReplyDelete